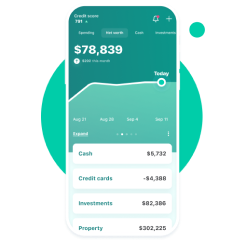

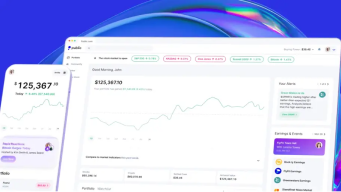

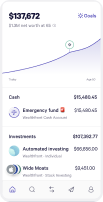

Mint is a popular budgeting app that syncs with your bank accounts and credit cards to track your spending. It also offers a variety of features to help you budget, including setting budgets, creating categories, and tracking your spending trends.

Visit website